"Bet your bottom Dollar?" These days the more appropriate question is: Where is the bottom of the Dollar? That’s because the US Dollar is starting 2011 in very poor fashion, with its value dropping relative to other currencies.

Let’s take a look at why... and what this could mean for home loan rates!

1. Some of the Dollar’s drop is attributed to the recent strength in the Euro, which has gotten a boost from some positive stories of late, like Spain and Portugal 's ability to sell debt in the Bond market without crisis. But the question is...have Europe 's problems gone away? No - there will be more problems ahead for the region and as they emerge, we should see a reversal in the Euro's strength along with improvement in the US Dollar.

2. Another reason for the Dollar's weakness is the Fed’s Quantitative Easing (known as QE2). Remember, while it would never be officially stated, one of the implicit aims of QE2 is to devalue the US Dollar in order to boost our exports and thus GDP.

At this point, the weakening US Dollar hasn't had a big negative effect on the US Bond market, but should the Dollar materially weaken, it could make US denominated assets like US Bonds less valuable and desirable amongst global investors...and it has been these foreign investors, like China, who have supported the US Bond market for years by purchasing our debt. Remember, home loan rates are tied to Mortgage Backed Securities, which are a type of Bond. So negative news for Bonds would also be bad news for home loan rates.

In housing news last week, Existing Home Sales for December were reported much better than expected. The jump in sales is likely attributed in part to the recent trend of rising home loan rates, which has prompted many homebuyers to take advantage of the still low home loan rates. Building Permits - which signal future construction - also came in better than expected last week, surging 17% in December.

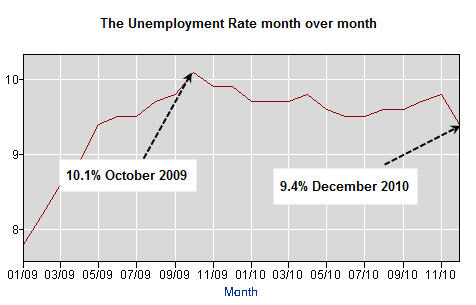

Relatively speaking, 2011 looks to be a good year for the housing industry. There will still be some areas that suffer price declines and those will be where foreclosure backlogs overhang and where unemployment rates are even higher than the national average. But housing has bottomed out in many areas and should see more of a pick up in the second half of 2011. And although home loan rates will likely rise slightly as the year progresses, they are still near all-time lows right now. That means homebuyers still have a tremendous opportunity in front of them.

If you or someone you know is considering purchasing a home, the combination of low home loan rates and affordable home prices make this an ideal time. Call or email today to discuss how you can benefit from the current situation.